HomeTax management software in USA

Tax Management

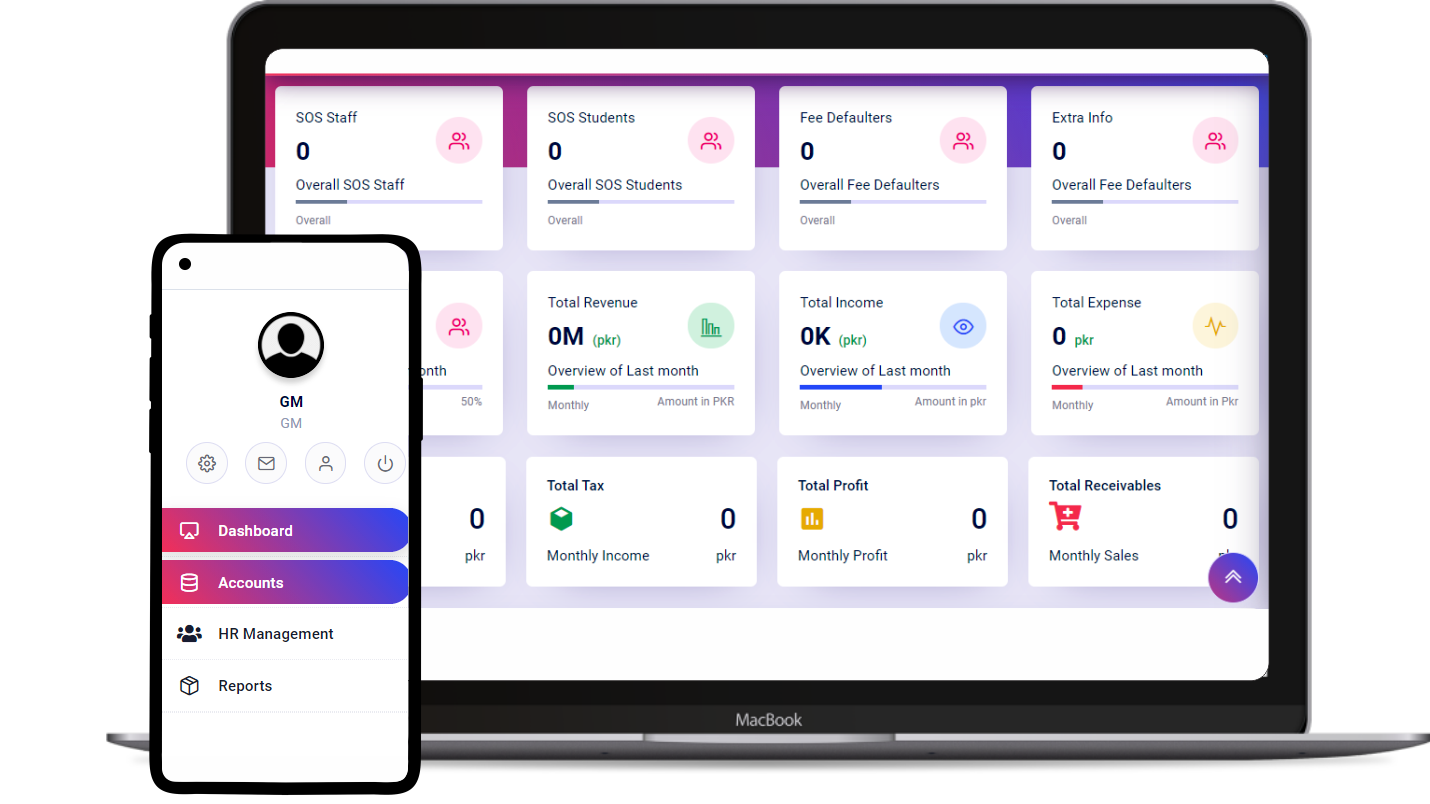

A tax is an obligatory financial charge or another sort of levy imposed by a governmental entity. The taxpayer pays it to support certain public expenses. The taxation system is critical for a country’s economic stability. This money is necessary to operate the government and handle the affairs of a state. The management of money for paying taxes is the responsibility of Tax Management Software in the USA. It concerns the timely filing of returns, audit accounts, tax deduction, sources etc. In addition, tax management helps in the avoidance of interest, penalties, and prosecution. The group’s legal and organizational framework is in charge of maintaining the information. It is the responsibility of software to complete associated responsibilities. The platform is adaptable to accommodate current and future requirements and processes. It helps control the data.